The Alberta government on Friday trimmed its 2018-2019 budget deficit estimate, but downgraded the 2019 economic growth forecast in the Canadian province due to faltering crude oil prices.

The Alberta government on Friday trimmed its 2018-2019 budget deficit estimate, but downgraded the 2019 economic growth forecast in the Canadian province due to faltering crude oil prices.

The deficit looks to reach $7.5 billion, compared with $7.8 billion projected in August, the government said in a statement.

The left-leaning New Democrat government led by Premier Rachel Notley had budgeted in April for an $8.8 billion deficit. She faces a provincial election in spring.

Low Canadian oil prices compared to the U.S. West Texas Intermediate benchmark (WTI) reflect full pipelines that have stranded crude supplies in Alberta, away from the U.S. refineries that buy the oil.

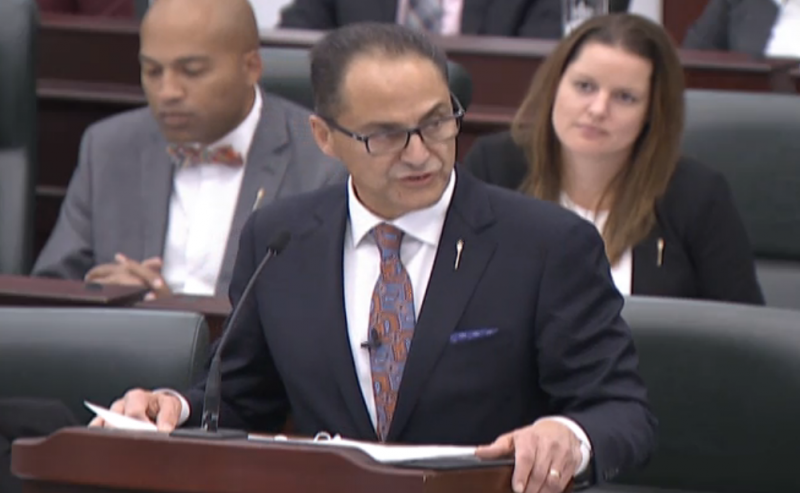

“This is a crisis,” Finance Minister Joe Ceci said in a statement, referring to the price discount known as the differential. “If the differential is not addressed, our entire country could be plunged into a downturn.”

The province downgraded its forecast for 2019 economic growth to 2 percent from a budgeted 2.5 percent, due to oil production curtailments amounting to 150,000 barrels per day and expected weaker corporate profits.