Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Succeeding in oil and gas development comes down to how well and how quickly you can analyze potential opportunities. Once a month, XI Technologies will apply its evaluation tools to a currently available asset to give readers a sense of the opportunities available and how they can be evaluated for A&D purposes.

For this month, XI will examine the sale of assets by Knowledge Energy Inc (Knowledge). Knowledge has engaged Sayer Energy Advisors to assist the Company with the sale of non-core oil and natural gas interest in Alberta.

Potential Deals

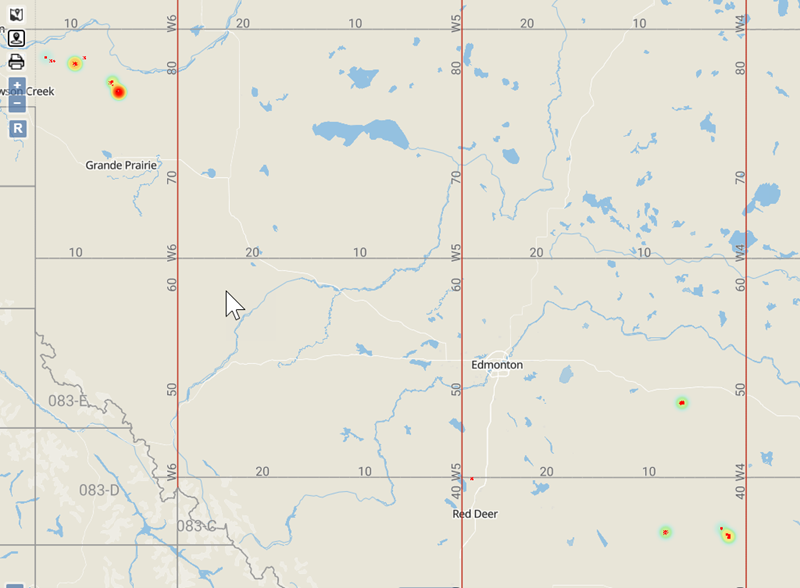

Knowledge states in their announcement that they are looking to sell all the properties in one transaction. This significantly limits the number of buyers who would have properties in both areas. So either the buyer would be looking to expand into one of the Knowledge properties or would work with a partner for the purchase who would be willing to split up the transaction. Here’s a heat map of the knowledge assets:

Using AssetBook, we can identify four companies with assets in both areas, thus who would be the most likely to be interested in the deal. We used the very narrow confines of the exact township and range coordinates provided by Sayer to complete this search and therefore there may be more companies close to both areas that could also be potential purchasers.

Asset Liabilities

One of the most important parts of A&D research is to look at the liabilities carried by the asset. We can provide an ARO list for the well assets listed for sale. XI’s industry leading cost model estimates the discounted Working Interest ARO value to be within reason with the LLR values calculated on these Assets. We’ve run reports on the liabilities on these assets, to download them click the following links:

These are just a few quick ways to do A&D prospecting, using a real-world example that is currently available for purchase. If you’d like to learn more about how XI’s AssetSuite can analyze potential acquisitions or more specific information for this evaluation, contact XI Technologies.