High global natural gas prices are reviving interest in many liquefied natural gas (LNG) projects around the world. Recent reports indicate at least three multibillion-dollar US proposals likely achieving enough supply contracts to start construction this year.

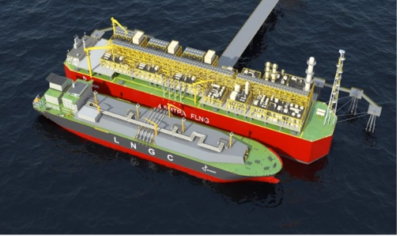

One Canadian project may be getting new life from high prices and high European demand along with revised project plans that propose a floating LNG option to reduce costs and time to build. Canadian natural gas producer Pieridae Energy (Pieridae) said on January 28 that it is evaluating a right-sized floating LNG facility for its Goldboro LNG project on Canada’s east coast.

While Pieridae made progress in advancing the previous Goldboro LNG Project, as of June last year, they weren’t able to meet all of the key conditions necessary to reach FID, citing cost pressures and time constraints due to COVID-19 as factors that made building the initial version of the LNG Project impractical. Pivoting to a floating LNG terminal (FLNG) became a practical option as it can take the form of either a fit-for-purpose build or a lease option on an existing vessel with an estimated CAPEX of C$2.2bn. The benefit of a leased vessel is that annual lease costs are an expense, reported on the company’s income statements and the company would not have to raise as much CAPEX upfront.

“The expected cost of the new offshore facility will be roughly C$2.2bn– much less than the C$10bn needed for the original project plan. Those costs drop even further with an option to lease an existing FLNG vessel. In addition, Goldboro has the advantage of a shorter shipping route to Europe- six days shorter than the shipping route from the US Gulf Coast or Qatar,” said James Millar, Director Of External Relations at Pieridae Energy.

The new cost structure, along with high natural gas prices in Europe would provide long-term economic viability for the company.

“Pieridae has a potential solution to the record energy shortages Europe is currently facing as well as a way to ease reliance on Russia as a primary natural gas supplier. We are analyzing a floating LNG option that would deliver net-zero, stable Canadian natural gas overseas, which would also support the energy transition to a lower-carbon economy,” according to Alfred Sorensen, CEO of Pieridae.

The current geopolitical situation between Ukraine and Russia is contributing to the need for global natural gas supply for Europe. Even though Russia is currently meeting contractual supply obligations, central European countries are concerned they don’t have sufficient capacity to supply their needs should Russian supply be curtailed.

According to James Millar, the German government recognized as much as a decade ago that they needed the security of natural gas supply. The Dutch government has been steadily reducing production from the Groningen gas field in the Netherlands after several earthquakes in the last decade created safety concerns. The decrease in gas production should lead to a complete reduction to 0 by the year 2030. Without other sources of natural gas, Europe finds itself too reliant upon Russian gas.

“Canada can play a role in supplying stable, reliable, net-zero gas,” says Millar. “In addition, Pieridae supplies conventional gas, as opposed to unconventional gas produced using multistage fracking, which Europeans appreciate more.”

It’s important to note that Pieridae is also Canada’s only fully integrated LNG company. The company’s focus is owning the entire value chain from the field where the gas is produced to the flange where that gas is liquified and shipped overseas. It is the largest Foothills producer in North America, producing from some of the biggest conventional gas reservoirs in North America.

“One of the advantages of being in Alberta is you’ve got an established transportation system,” says Millar. “We connect to TC Energy’s mainline across the country which connects to the Trans Québec & Maritimes Pipeline (TQM) and Quebec, then the PNGTS (Portland Natural Gas Transmission System) which connects to the U.S. Maritimes Northeast Pipeline (owned by Enbridge) and Maritimes Northeast goes right to the Halifax area – the front door of Goldboro in Halifax.”

Pieridae is also developing its Caroline Carbon Capture Power Complex – to use CCS and clean power to offset Goldboro LNG emissions and satisfy Europe’s desire to source lower carbon gas.

“It became apparent that for us to be successful at our LNG project, we had to come up with a carbon solution,” said Alfred Sorenson, president of Pieridae Energy. “Europeans in particular, which are our core market, are very much looking for suppliers of LNG to be able to show how they are minimizing their impact on the environment. That was the impetus to find a solution.”

Maureen McCall is an energy professional who writes on issues affecting the energy industry