Obsidian Energy released its 2023 guidance last night, see here for all the details. Thanks to BOE Intel, we can quickly compare a few of the company’s guidance metrics to the data that we have. For more information on BOE Intel and the launch of our new software, click here. The charts below are all from BOE Intel.

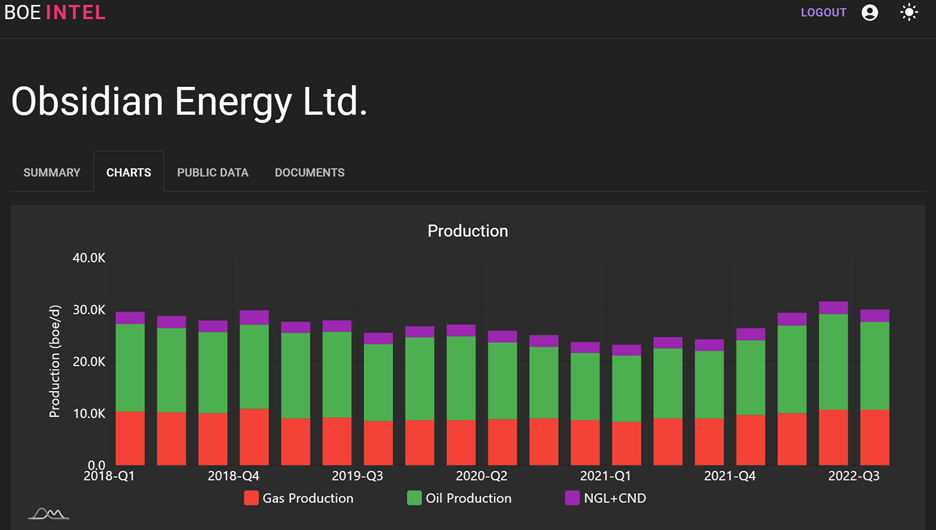

- Obsidian 2023 production guidance is 32,000 – 33,500 boe/d. This would suggest production growth of ~7% YoY. Obsidian also announced Q4 2022 production was 31,742 boe/d.

- BOE Intel says: That production guidance, if achieved, would mark a 5-year high for the company (see chart below). The median production growth guidance of the companies tracked by BOE Intel is 9%.

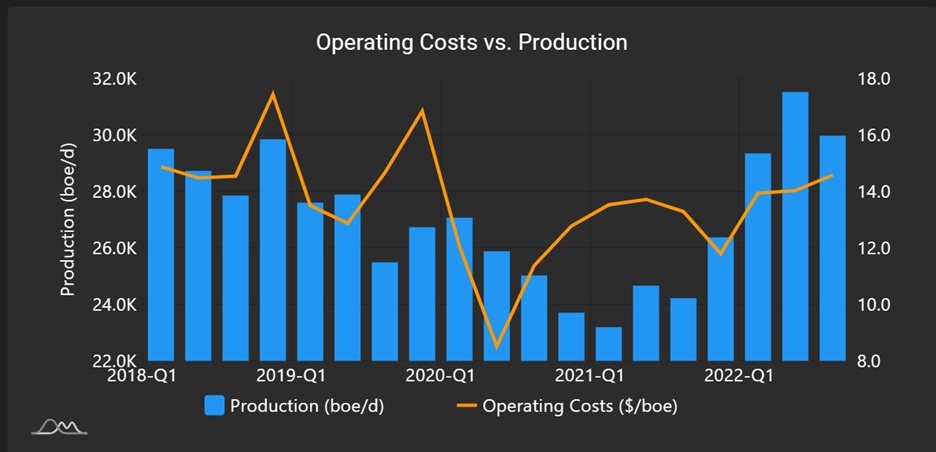

- Obsidian 2023 operating cost guidance is $13.50 – $14.40/boe. The company is guiding to slightly lower op costs in 2023 as “higher production helps offset the impacts of inflationary pressures and planned facility turnaround activity during the year.”

- BOE Intel says: The last 3 quarters operating costs for Obsidian were $13.90/boe (Q1 2022), $14.00/boe (Q2 2022) and $14.60/boe (Q3 2022). The median producer in our dataset had operating costs of $11.90/boe in Q3 2023. This number has been trending higher industry wide for the last couple of years.

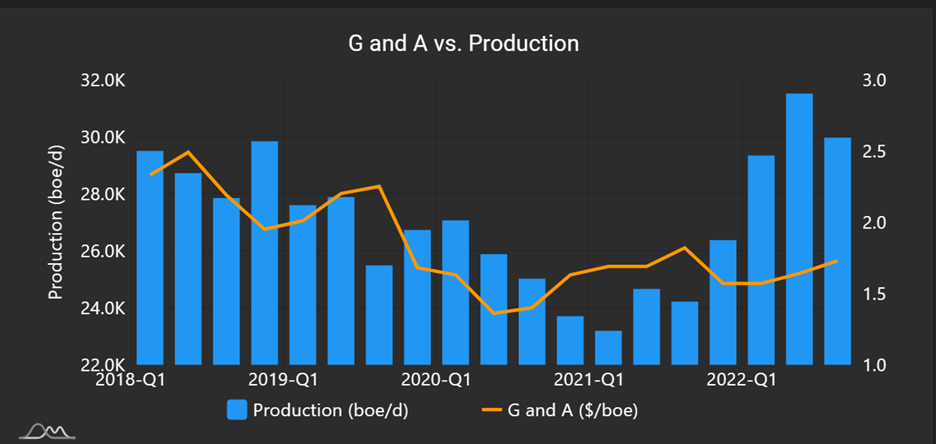

- Obsidian is guiding to G&A of $1.60 – $1.70/boe.

- BOE Intel says: The last 3 quarters were in that range. The median producer in our dataset had G&A costs of $1.50/boe in Q3 2023.

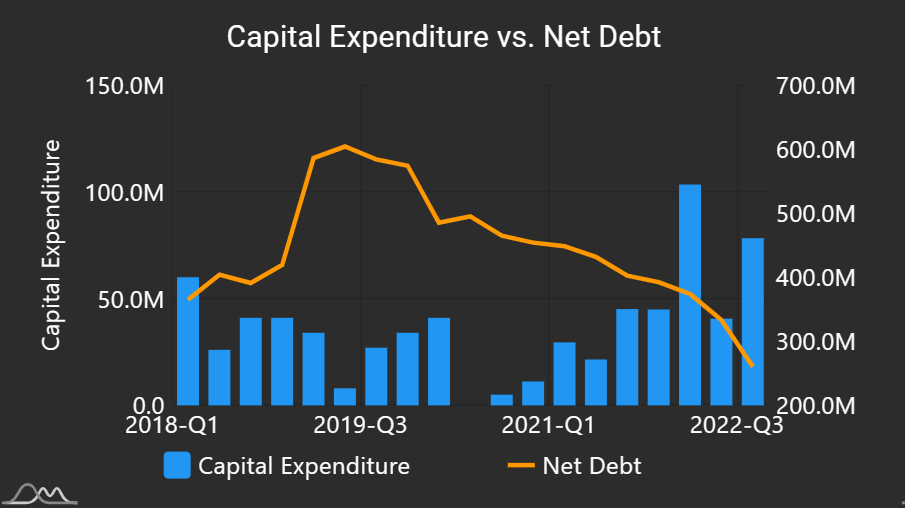

- Obsidian is guiding to net debt at YE 2023 of $215 MM, prior to the impact of any share repurchases.

- BOE Intel says: Net debt is falling sharply, and was $260.5 MM at the end of Q3 2022.