The past month has been a very active period for licensing activity in the Canadian oil patch. In total, there were 591 wells licensed between April 11, 2023 and May 11, 2023, a 39.4% increase over the previous month and a 4.0% increase over activity in February and March (you can find last month’s article here). These licences were also distributed to a larger number of companies in this period; there were 61 unique licensees in the past month, compared to 48 in the month prior. Using data from BOE Intel and Petro Ninja, we’ve identified a number of trends across the various producers and producing formations.

Top Producers

| Top Licensees | ||

|---|---|---|

| Licensee | Count | |

| Whitecap Resources Inc. | 46 | |

| ARC Resources Ltd. | 41 | |

| Lycos Energy Inc. | 41 | |

| Crescent Point Energy Corp. | 33 | |

| Tamarack Valley Energy Ltd. | 30 | |

| Spur Petroleum Ltd. | 29 | |

| Canadian Natural Resources Limited | 27 | |

| Teine Energy Ltd. | 26 | |

| Strathcona Resources Ltd. | 20 | |

| Ovintiv Canada Ulc | 20 | |

| Others | 278 | |

| Total | 591 | |

Among the most active companies over the past month, there are some noteworthy trends:

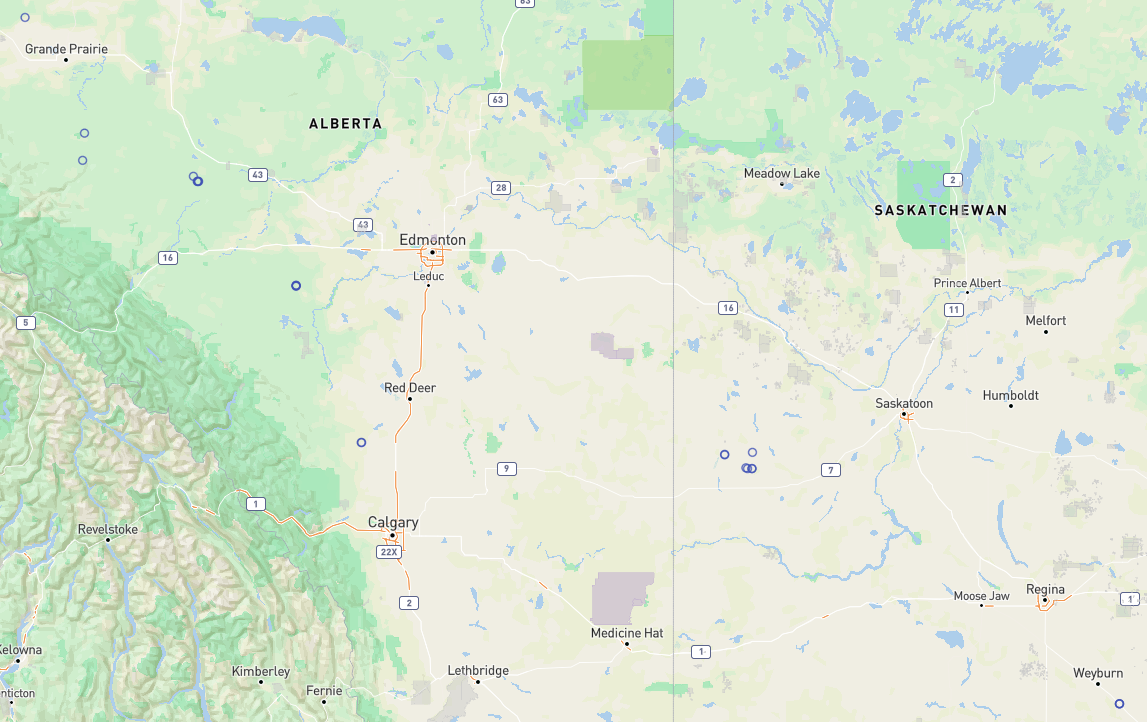

- Whitecap was the most active licensee in this period, with activity across wide swathes Alberta and Saskatchewan. Of Whitecap’s 37 licences for which information on producing formations is available, 29.7% targeted the Viking. Other formations receiving significant focus from Whitecap include the Cardium, the Duvernay, and Midale with 5 licences each.

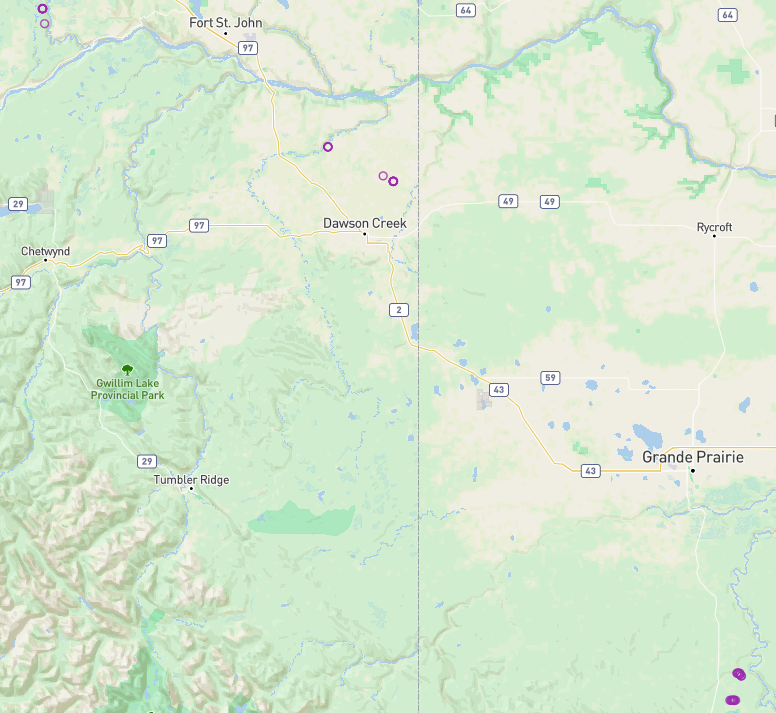

- ARC Resources continues to focus heavily in the Montney; all 41 of their licences in the past month were focused in this producing formation. Just under a quarter were licensed in its holdings in the Karr field in Alberta, while the remainder were split between its land positions in the Greater Dawson area and at Attachie. We might expect to see more licensing from ARC in this region in the future, following board approval of the sanctioning of the Attachie Phase I project on May 4.

- Lycos Energy, a smaller oil-weighted producer that completed a $50 million transaction in Lloydminster back in March, licensed 41 wells in Saskatchewan’s Cut Knife field.

- Crescent Point Energy’s licensing activity was focused entirely in Saskatchewan; all 33 of their wells licensed in the past month were in their Saskatchewan assets. Recall that Crescent Point has also been busy in Alberta with the acquisition of Alberta Montney assets from Spartan Delta back in March.

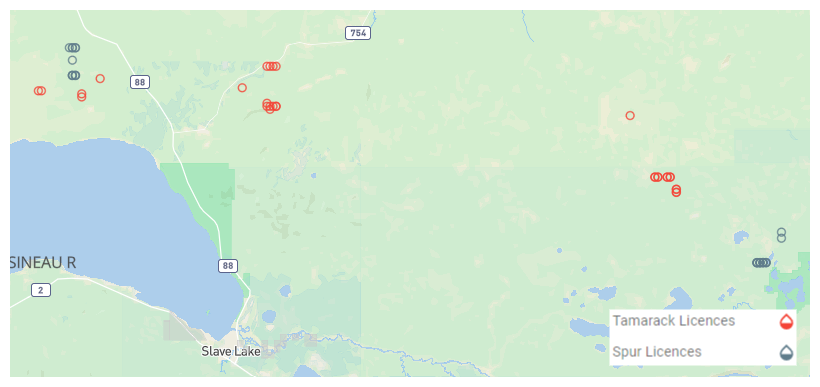

- Tamarack Valley continues to be one of the most active companies in the Clearwater; all of Tamarack Valley’s 30 new licences target this producing formation.

- Tamarack Valley and Spur Petroleum have similar licensing activity in the last month; the 5th and 6th most active licensees have many nearby locations licensed within the Clearwater.

Whitecap’s geographically diverse licences between April 11 and May 11, 2023

Tamarack Valley and Spur’s proximal Clearwater licences

ARC Resources’ licences from the past month

Top Producing Formations

With respect to more general trends across the major producing formations, we’ve identified the following:

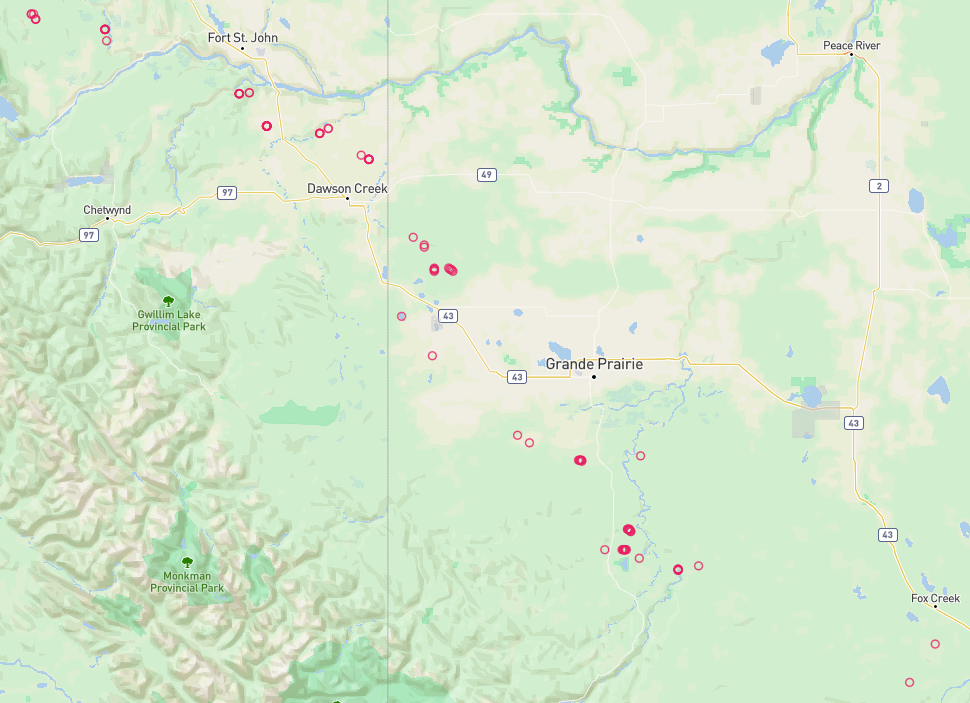

- Activity in the past month was skewed towards smaller producers. Among the top 5 producers in our dataset by Q4 2022 production (CNRL, Cenovus, Ovintiv, Tourmaline, Imperial Oil), only CNRL and Ovintiv cracked the list of top 10 most active licensees. Ovintiv’s activity was concentrated entirely in the BC Montney, while CNRL split fairly evenly among various producing formations.

- As was the case in our March-April licence activity review, the Montney was the producing formation targeted most with 110 licences. Other popular formations include the Clearwater (76 licences), the Viking (licences 61), and the Spirit River (25 licences).

- The Clearwater, in particular, saw a marked month-over-month increase in activity growth. Licensing grew from 39 in March-April to 76 last month, a 94.9% increase. Tamarack Valley and Spur Petroleum accounted for a combined 77.6% of total Clearwater licensing activity.

| Top Producing Formations | ||

|---|---|---|

| Producing Formations | Count | |

| Montney | 110 | |

| Clearwater | 76 | |

| Viking | 61 | |

| Spirit River | 25 | |

| Cardium | 24 | |

| McMurray | 20 | |

| Duvernay | 20 | |

| Frobisher | 19 | |

| Waseca | 15 | |

| Lloydminster | 15 | |

| Others | 206 | |

| Total | 591 | |

Montney licences from all producers in the past month

This analysis was made possible with data and tools provided by BOE Intel and Petro Ninja. To get more information or to schedule a demo of the full capabilities of these products, please contact us.