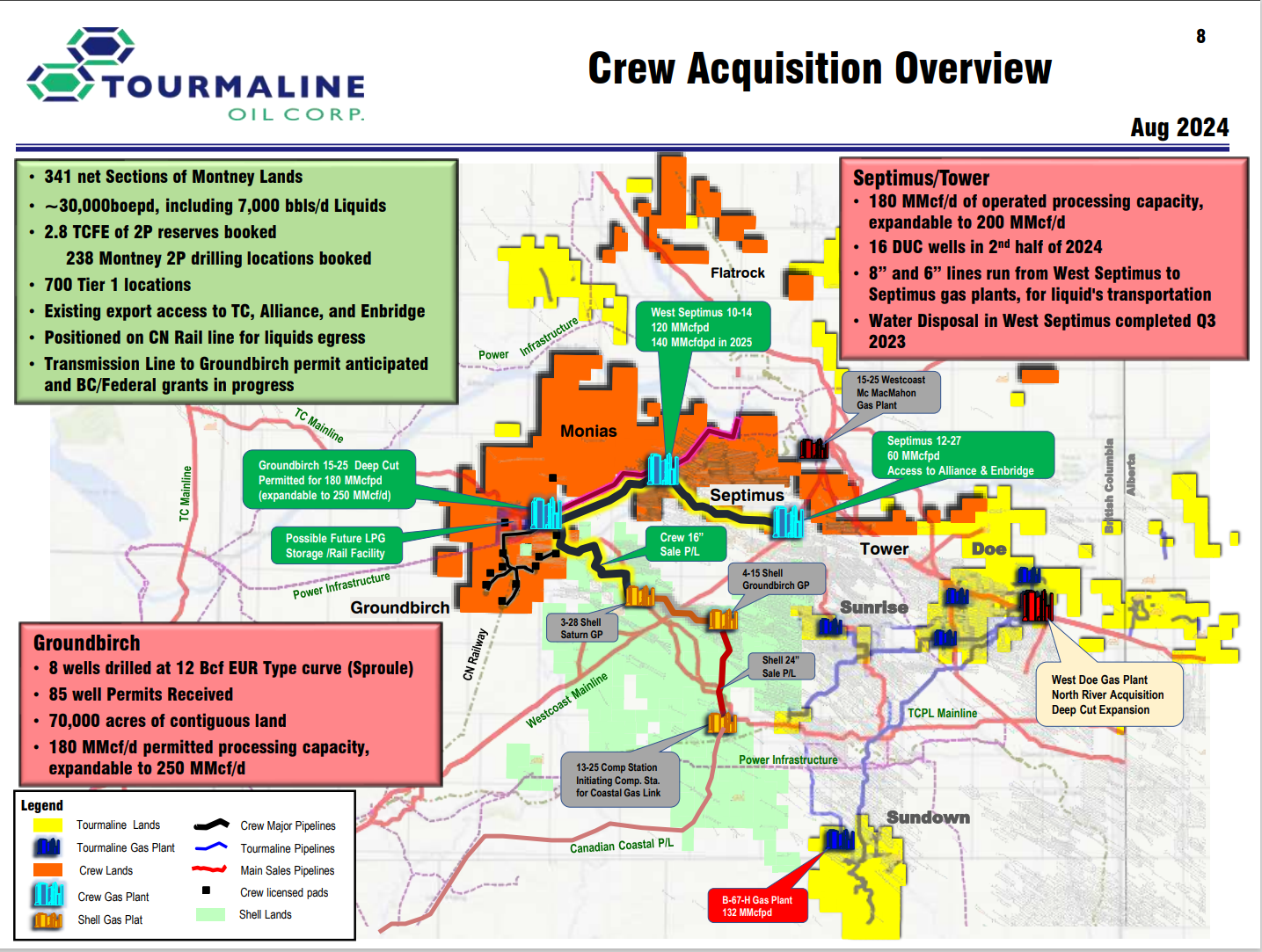

Tourmaline announced yesterday that it will acquire Crew Energy for total value of approximately $1.3 billion. Stated volumes in the press release were 29,000-30,000 BOE/d. The company updated its corporate presentation with a few new slides, highlighting ~341 net sections of Montney land will be acquired as well as 700 Tier 1 locations.

Tourmaline cited a few reasons for the acquisition. In the press release, Tourmaline said it “believes this is an opportune time for consolidating natural gas assets prior to imminent major growth in the North American LNG business and acceleration of natural gas-powered electrical generation requirements across the continent.” The company also mentioned in its new presentation that Crew fit with what Tourmaline looks for in terms of acquisition criteria: “geographic fit, material production and reserve growth potential, deep Tier 1 inventory, growing FCF accretion, strong liquids production, infrastructure synergies, a myriad of facility and field optimization opportunities, modest size acquisition corporately.”

The pro forma asset map is included below.

Figure 1 – Tourmaline corporate presentation slide

Source: Tourmaline Corporate Presentation

The acquisition price works out to around $44,068/BOE/d. In Figure 2 below, we show some comparables for Montney transactions over the last few years. It has been a couple of years since we last saw substantial M&A in the BC Montney, so we’ve broken down the table to show BC Montney transactions and AB Montney transactions separately.

Figure 2 – M&A comparables – BOE Intel (turn sideways to view full table on mobile)

| Date | Type | Acquirer | Target | Value ($) | Region/Play | BOE/d | % liquids | $/BOE/d |

|---|---|---|---|---|---|---|---|---|

| 2024-08-12 | Corporate | Tourmaline Oil Corp. | Crew Energy | 1,300,000,000 | BC Montney | 29,500 | 44,068 | |

| 2023-11-06 | Corporate | Crescent Point | Hammerhead Energy | 2,550,000,000 | Alberta Montney | 56,000 | 48 | 45,536 |

| 2023-08-01 | Corporate | Strathcona Resources | Pipestone Energy Corp. | 920,000,000 | Montney | 33,143 | 41 | 27,759 |

| 2023-03-28 | Asset | Crescent Point | Spartan Delta Corp. | 1,700,000,000 | Alberta/Montney | 38,000 | 55 | 44,737 |

| 2022-06-28 | Corporate | Whitecap Resources | XTO Energy Canada | 1,700,000,000 | Montney/Duvernay | 32,000 | 30 | 53,125 |

| 2022-03-28 | Corporate | Vermilion Energy | Leucrotta Exploration | 477,000,000 | Montney | 13,000* | 36,692 | |

| 2021-11-10 | Corporate | Canadian Natural Resources Limited | Storm Resources | 960,000,000 | Montney | 28,267 | 19 | 33,962 |

| 2021-06-11 | Corporate | Tourmaline Oil Corp. | Black Swan Energy | 1,100,000,000 | North Montney | 50,000 | 22,000 |

*Press released acquisition volumes of 13,000 BOE/d were a forward looking number. Actual volumes at the time were likely significantly lower.

**BC Montney transactions highlighted in green

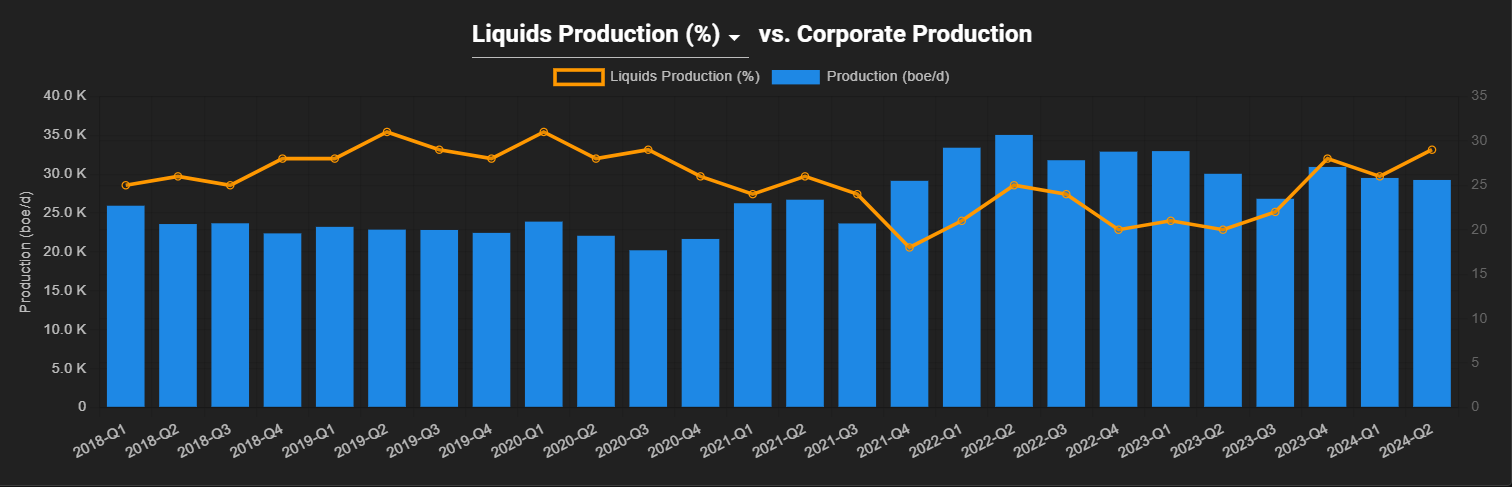

The press release did not contain an assumed liquids percentage for the Crew volumes, but Tourmaline’s presentation suggests 7,000 bbl/d of liquids production from the assets, while Crew’s 2024 Q2 reported volumes included 8,620 bbl/d of liquids production including 6,131 bbl/d of condensate. Crew’s liquids percentage reached 29% in the quarter (Figure 3), which was a multi-year high, as the company had been targeting the condensate rich part of its acreage recently.

Figure 3 – Crew Energy liquids % (2018 to Q2 2024) – BOE Intel

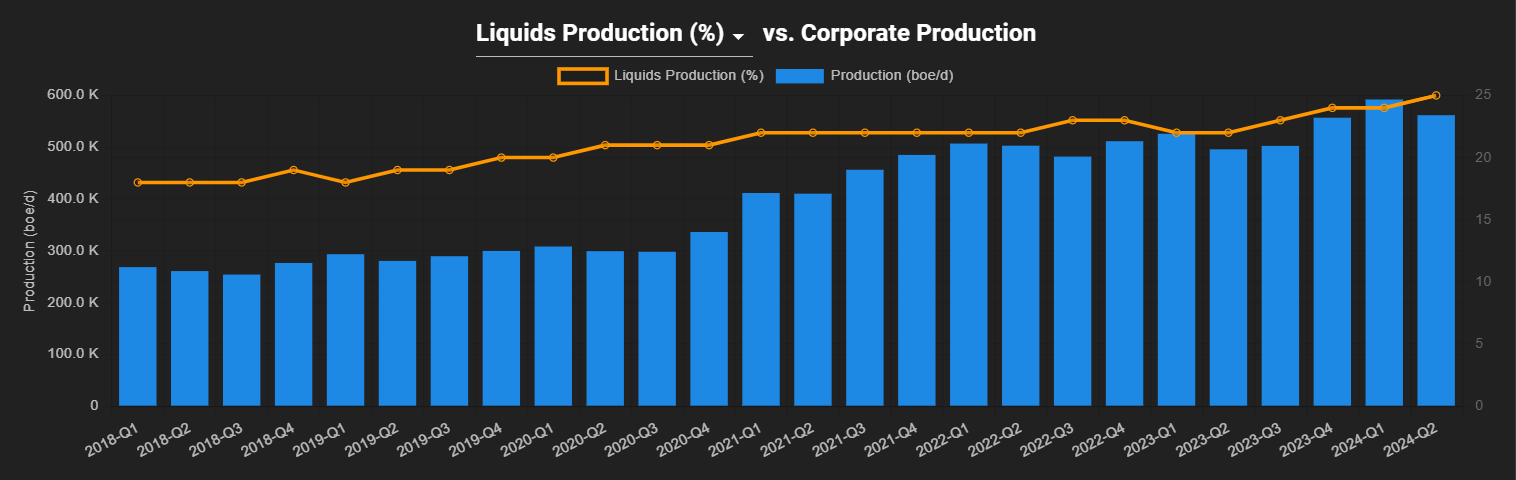

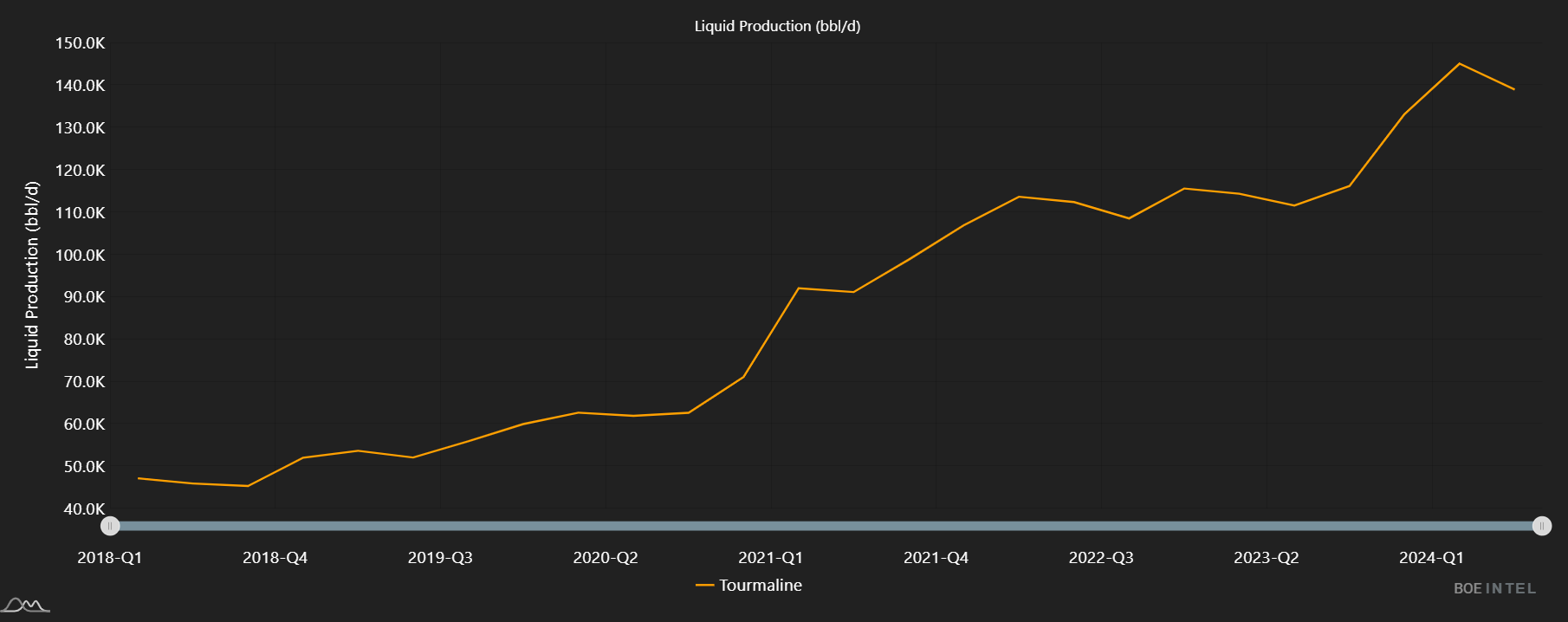

While Tourmaline is the largest, and arguably most successful natural gas company in Canada (and maybe beyond?), it has also grown a very significant liquids business in its own right, both organically and through strategic acquisitions. By Q2 2024, Tourmaline’s liquids weighting had grown to 25% (from 18% in 2018), while liquids volumes have tripled in that time frame on an absolute basis from 47,070 bbl/d to 138,906 bbl/d.

Figure 4 – Tourmaline Liquids Weighting (%) – 2018 to Q2 2024 – BOE Intel

Figure 5 – Tourmaline liquids production (2018 to Q2 2024) – BOE Intel

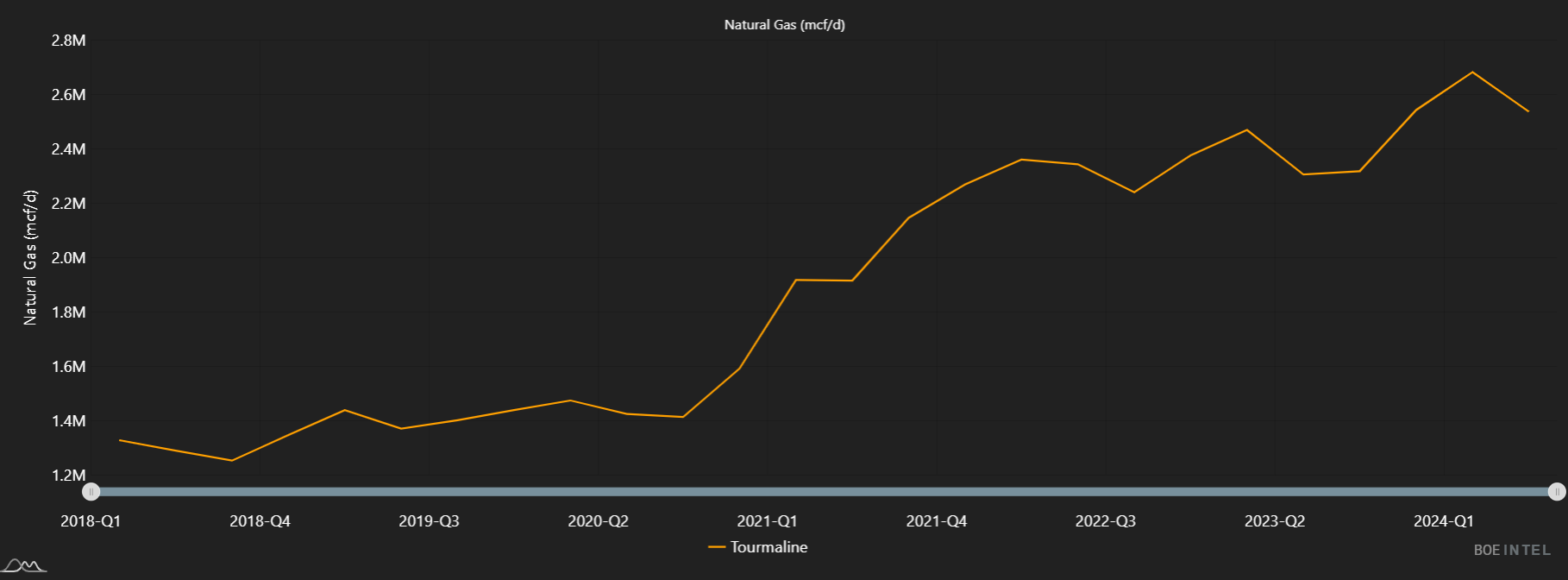

In Q2 2024, Tourmaline produced ~2.5 BCF/d of natural gas (Figure 6), as it continues to widen its lead as largest natural gas producer in Canada. The absolute level of natural gas production as well as the remarkable depth of future inventory certainly appears very strategic; in particular as LNG Canada is set to begin exporting natural gas possibly next year.

Figure 6 – Tourmaline natural gas production (2018 to Q2 2024) – BOE Intel

In conjunction with the acquisition, Tourmaline raised its base dividend by 6% ($0.33/sh. quarterly to $0.35/share) and revised its 2024 annual production guidance to 582,500 – 592,500 BOE/d from 575,000 – 585,000 BOE/d.