Earnings of $333 million, an increase of $434 million compared to the same period of 2016 Strong petroleum product sales driven by long-term, high value supply agreements Upstream production impacted by a fire at the Syncrude Mildred Lake upgrader CALGARY, April 28, 2017 /CNW/ - First quarter (millions of Canadian dollars, unless noted) 2017 2016 % Net Income (loss) (U.S. GAAP) 333 (101) 430 Net Income [Read more]

Headlines

Vermilion Energy Inc. Announces Results for the Three Months Ended March 31, 2017

CALGARY, April 28, 2017 /CNW/ - Vermilion Energy Inc. ("Vermilion", "We", "Our", "Us" or the "Company") (TSX, NYSE: VET) is pleased to report operating and unaudited financial results for the three months ended March 31, 2017. The unaudited financial statements and management discussion and analysis for the three months ended March 31, 2017, will be available on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com, on EDGAR at www.sec.gov/edgar.shtml, and on [Read more]

Exxon Mobil’s 1Q profit more than doubles

IRVING, Texas - Exxon more than doubled its profit in the first quarter as rising crude prices magnified the cost cuts made by the company as energy prices tumbled. The Irving, Texas, company earned $4.01 billion, or 95 cents per share, for the three month period, up from $1.81 billion, or 43 cents per share, a year earlier. It's the first year-over-year profit gain for Exxon since the third quarter of 2014, when the price of oil was just beginning a plunge that took it below $30 a [Read more]

Enbridge Inc. Announces Conclusion and Outcomes of Enbridge Energy Partners, L.P. Strategic Review

CALGARY, ALBERTA--(Marketwired - April 28, 2017) - Enbridge Inc. (TSX:ENB)(NYSE:ENB) (Enbridge or the Company) announced today that the strategic review of Enbridge Energy Partners, L.P. (NYSE:EEP) (EEP or the Partnership) has been completed. The following actions, together with the previously announced measures earlier this year, have been taken to restore EEP's value proposition to its unitholders and to Enbridge. Acquisition of Midcoast Assets - Enbridge, through its wholly owned U.S. [Read more]

Expected Increase in Railway Fuel Costs Contributes to a 4.1 percent Increase in the Volume-Related Composite Price Index for Crop Year 2017-2018

OTTAWA, April 28, 2017 /CNW/ - The Canadian Transportation Agency (Agency) announced a 4.1 percent increase in the Volume-Related Composite Price Index (VRCPI), which is used in determining the Maximum Revenue Entitlement (MRE) for the Canadian National Railway Company (CN) and the Canadian Pacific Railway Company (CP) for the movement of western grain. Determination No. R-2017-37 sets the VRCPI at 1.3817 for the 2017‑2018 crop year, which will begin on August 1. [Read more]

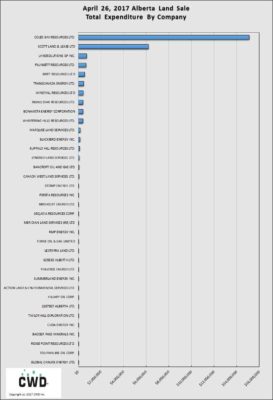

April 26 Alberta Land Sale Earns $26.6 Million

This week's Alberta land sale has earned the province $26.6 million in Lease and License fees from petroleum and natural gas leases. The total for the first seven sales of 2017 so far is $109.3 million, compared to $39.3 million earned by this time last year. The interactive map below shows the lease locations. There were a total of 103 parcels with successful bids for this sale. The chart below illustrates the trend of the Alberta land sales since the beginning of the year and also [Read more]

Suncor CEO says more oilsands deals may appear in ‘exodus’ of foreign firms

CALGARY — Suncor Energy (TSX:SU) has a potential opportunity to make further purchases in Alberta's oilsands if foreign multinationals continue to exit the sector, the oil and gas company's chief executive said Thursday. Suncor feels no pressure to buy but is watching closely for opportunities and has the financial strength to act, Suncor CEO Steve Williams on a conference call with analysts. Williams said he doesn't think the "exodus" from the Alberta oilsands by big international [Read more]

Relentless Announces Year-End 2016 Results and Filing of Reserves Disclosure

CALGARY, ALBERTA--(Marketwired - April 27, 2017) - Relentless Resources Ltd. ("Relentless" or the "Company") (TSX VENTURE:RRL) announces the filing of its audited financial statements and related management's discussion and analysis ("MD&A") for the year ended December 31, 2016. The Company also announces the filing of its reserves data and other oil and natural gas information ("51-101 Information"), as required under National Instrument 51-101. The financial statements, MD&A and 51-101 [Read more]

Marksmen Announces Consolidated Financial Results for the Year Ended December 31, 2016 and Operational Update

CALGARY, ALBERTA--(Marketwired - April 27, 2017) - Marksmen Energy Inc. ("Marksmen" or the "Company") (TSX VENTURE:MAH)(OTCQB:MKSEF) and its wholly owned subsidiary Marksmen Energy USA, Inc. announces financial results for the year ended December 31, 2016. The following documents have been filed on SEDAR: Audited Financial Statements Management's Discussion and Analysis ("MD&A") Form NI 51-101F1 Statement of Reserve Data and Other Oil and Gas Information. Form NI 51-101F2 [Read more]

Manitok Energy Inc. Announces the Acquisition of Natural Gas Production and Related Strategic Pipeline System and A Year Over Year First Quarter Production Increase of 39%

CALGARY, ALBERTA--(Marketwired - April 27, 2017) - Manitok Energy Inc. ("Manitok" or the "Corporation") (TSX VENTURE:MEI) is pleased to announce that it has completed an acquisition from an Alberta based oil and gas company to acquire a 100% working interest in approximately 1.1 Mmcf/d (175 boe/d) of natural gas production, based on field estimates, in the Carseland, Alberta area (the "Acquisition"). In addition to the current production, the Acquisition includes 13 sections of developed [Read more]