TSX, NYSE: BXE - CALGARY, July 7, 2016 /CNW/ - Bellatrix Exploration Ltd. ("Bellatrix" or the "Company") (TSX, NYSE: BXE) is pleased to announce that it has entered into an agreement to sell a 35% minority interest in the Bellatrix O'Chiese Nees-Ohpawganu'ck deep-cut gas plant at Alder Flats (the "Alder Flats Plant") to Keyera Partnership ("Keyera"), one of the current co-owners of the Alder Flats Plant, for cash consideration of $112.5 million. The transaction further validates the material [Read more]

Headlines

Keyera to Acquire an Additional Ownership Interest in the Alder Flats Gas Plant

CALGARY, July 7, 2016 /CNW/ - Keyera Corp. (TSX:KEY) ("Keyera") announced today that it has agreed with Bellatrix Exploration Ltd. ("Bellatrix") to acquire an additional 35% ownership interest in the O'Chiese Nees-Ohpawganu'ck gas plant (the "Alder Flats Plant") and the associated gathering pipelines (collectively the "Facilities"). The total consideration for the acquisition is $112.5 million, which includes the additional working interest in the Facilities, a 10-year take-or-pay commitment, an [Read more]

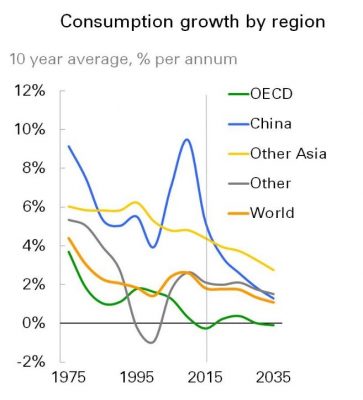

World demand for oil and gas will continue to increase

World demand for oil and gas will continue to increase during the next 20 years even while the use of renewable energy increases dramatically during the same period. Those who are pushing mankind to take dramatic steps to reduce the use of fossil fuels more rapidly and accelerate the use of renewables more rapidly should read the recently released 2016 edition of the BP Energy Outlook for a reality check. While this demand forecast is good news for our beleaguered Canadian oil and gas [Read more]

We all love to travel, which requires fossil fuels

Eliminating the use of fossil fuels depends on kicking our addiction to just tooling around. The absolute single best day — no, the single best moment — of my entire year is sitting in the parking lot waiting for the Starbucks to open on the Friday before Labour Day. With a full tank of gas, a smooth open road ahead, decent weather and nothing but free time it simply doesn’t get any better. In a year defined by its constraints it is the instant when I feel most free. Road trip. Obviously, I’m [Read more]

Birchcliff Announces Filing of Final Short Form Prospectus, Expected Closing of Financings for Gross Proceeds of $690.8 Million and Refiling of Annual Information Form

CALGARY, ALBERTA--(Marketwired - July 7, 2016) - Birchcliff Energy Ltd. ("Birchcliff" or the "Corporation") (TSX:BIR) is pleased to announce that it has filed its (final) short form prospectus (the "Prospectus") with the applicable securities regulatory authorities in each of the provinces of Canada and received a receipt therefor in respect of its previously announced bought-deal financing of 101,520,000 Subscription Receipts ("Subscription Receipts") at a price of $6.25 per Subscription [Read more]

US says oil inventories declined but not as much expected

NEW YORK - Oil prices are falling on a government report that crude inventories are declining less than expected. The Energy Information Administration said Thursday that inventories fell by 2.2 million barrels last week. S&P Global Platts had forecast a decline of 2.6 million barrels. Benchmark U.S. crude is down $2.19, or 4.6 per cent, to $45.24 a barrel in afternoon trading on the New York Mercantile Exchange. Brent crude, the international price, is down $2.18, or 4.5 per [Read more]

Oil drops more than 4% on disappointing weekly crude draw

Oil prices fell nearly 5 percent on Thursday, reversing early gains after the U.S. government reported a weekly crude draw that disappointed investors expecting larger declines. Brent crude oil futures fell $2.28, or 4.7 percent, at $46.52 per barrel at 1:06 p.m. ET (1706 GMT) on Thursday. It rose 1.6 percent earlier to a session high of $49.59. WTI crude was trading at $45.16 per barrel, down $2.27, or 4.8 percent. Oil prices have risen more than 70 percent from 12-year lows of around [Read more]

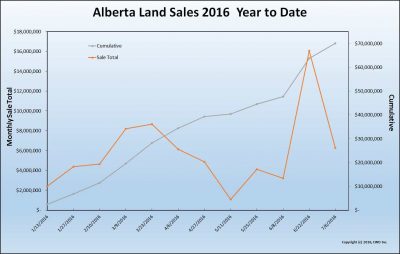

July 6 Alberta Land Sale Results in $6.28 million

The 12th Alberta land sale of the year, held yesterday on July 6, has netted the Province of Alberta a total of $6.282 million. This is the 4th highest result so far, for 2016. This follows on the heels of the largest sale of the year held two weeks ago, on June 22, which brought in a respectable $16.1 million. There were a total of 85 parcels with acceptable lease bids, including 5 Oil Sands lease. The total for all 12 sales so far this year is $$70.1 million. The chart [Read more]

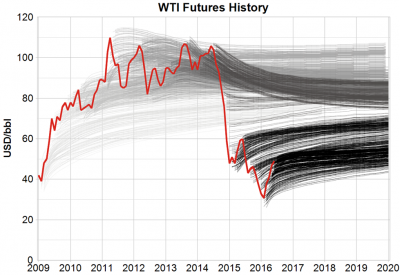

GLJ Petroleum’s July 1, 2016 Price Forecast

In the second quarter of 2016, a substantial recovery in crude prices has taken place, with both Brent and WTI prices rising from the mid-30s to the high 40s. It’s difficult to attribute this streak to any single reason, but we can certainly identify some of the contributing factors. First, US Dollar weakness has boosted nearly all commodity prices worldwide, including energy prices. While it has recovered from its early-May low, the US Dollar has fallen about 4 percent against a basket of [Read more]

Pipelines are consulted to death, and it’s killing jobs and productivity

Perhaps the biggest loss for oil and gas advocacy groups has been in the arena of consultation. The industry has happily and oftentimes cheered, as if it is major progress, entering the arena of consultation, but what industry has perpetually been stepping into is no less than a death sentence for the most important infrastructure projects this country desperately needs. The Northern Gateway Pipeline approval was just quashed by the federal courts for failing to 'adequately' consult various [Read more]