At this point, it goes without saying Alberta has been hit especially hard with the recent and prolonged declines in the prices of oil and gas.

To put the job losses in perspective, consider this: The entire US energy industry has lost a total of 70,000 jobs year over year. In Alberta, oil patch job losses have so far amounted to 35,000 according to CAPP this past fall. What’s worse, the whole Alberta economy lost 63,500 jobs in the first eight months of this year, according to government data.

As a reminder, the US has a total population of 315 million. Alberta has a population of 4.2 million. Total US oil production sits at 9.1 mmbbl/d while Alberta’s total oil production amounts to 3.5 mmbbl/d.

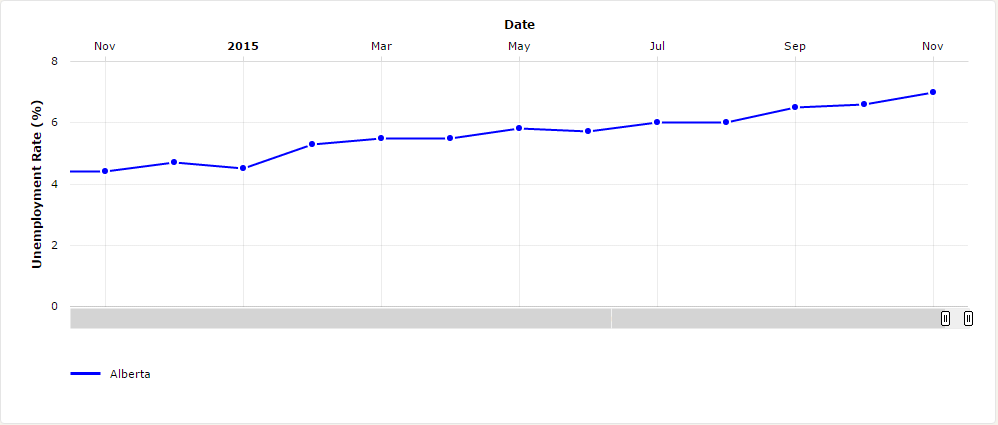

In November 2015, Alberta’s seasonally adjusted unemployment rate was 7.0%, up from the 4.4% rate that was registered a year earlier and from last month’s 6.6% rate

There is no question that the impact of these job losses on Alberta relative to the United States is huge. For a sub-sovereign state to lose close to the same amount of industry related jobs as the world’s largest economy, something has to give.

But there is only so much that can be done on the part of both industry and government to alleviate the pain.

And so as the oil and gas industry redirects its priorities to a heightened focus on cost management and overall fiscal prudence (with the associated layoffs), times like these call for renewed industry support from government.

Yet, it seems the Alberta government is preoccupied with following through on campaign promises better suited to a time when the price of oil hovered around $100. It should come as no surprise then that talk of recall legislation is already creeping into the public discourse after only eight months of rookie NDP leadership.

As was written by the BOE Report’s Petur Radevski, “the province already gave the NDP its chance when it granted them a majority. But to ask for blind acquiescence for the next four years is simply outrageous. Not when so much harm has been done to Alberta and not when so many jobs have been lost and lives have been disrupted. Certainly not when there is still time to reverse course and stave off complete disaster.”