Canadian licensing activity increased for the third month in a row. From November 13 to December 12, 1,004 licences were obtained. This represents an impressive 45.2% increase compared to the previous month, which saw companies obtain 691 new licences. This past month’s licences were spread across 93 unique licensees, representing an average of 10.8 licences per licensee. Overall, the month was dominated by oil sands producers with Cenovus, Suncor, CNRL and MEG Energy occupying the top 4 spots. Using data from BOE Intel and Petro Ninja, we’ve identified a number of trends across the various producers and producing formations.

Licensees

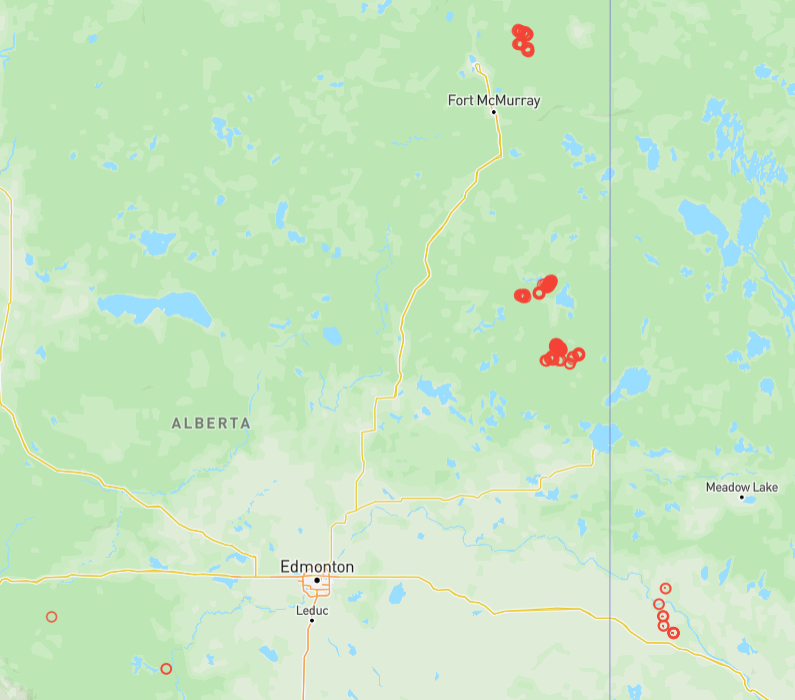

- In an impressive display of licensing, Cenovus obtained over 220 this month. The majority appear to target the company’s oil sands assets in Alberta, with just over 20 targeting the Waseca formation in Saskatchewan. The oil sands licences appear to be spread evenly across its main asset groups, with Foster Creek, Christina Lake and Sunrise all receiving some attention. This does not come as a huge surprise: Cenovus allocated $2.5 – 2.75 billion in capital spending to its oil sands assets in its recently released 2024 budget.

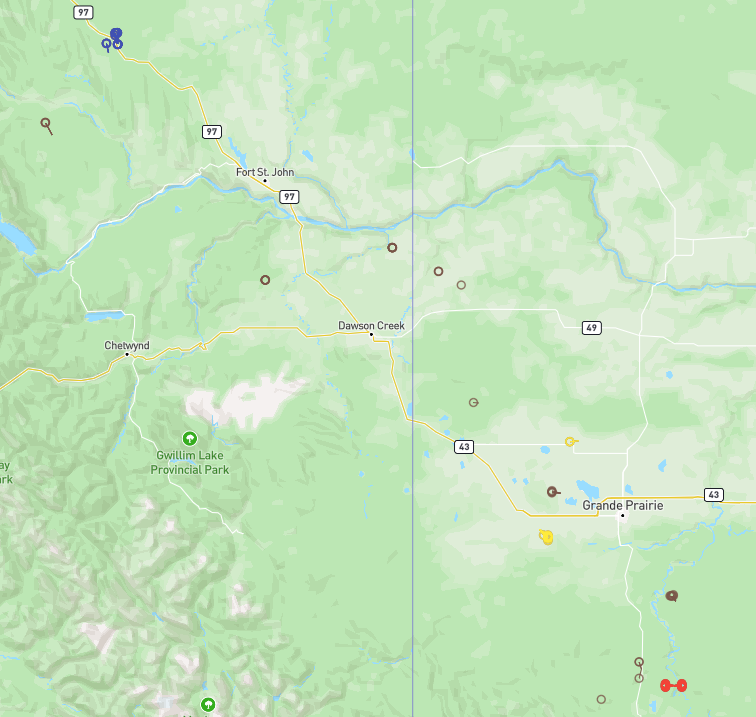

- ConocoPhillips Canada obtained 36 licences during the period, split fairly evenly between its oil sands and BC Montney asset groups. Recall that the company purchased the remaining 50% working interest in the Surmont oil sands project back in October 2023, signaling a renewed commitment to the asset. The company’s November-December Montney licences are tucked between existing wells, as shown in the well map below. Check out our recent article on ConocoPhillips’ Canadian operations here, which highlights even more licensing activity and production results.

- On the theme of oil sands acquisitions, Suncor Energy was also active during the period. Having closed its acquisition of TotalEnergies’ working interest in the Fort Hills Project in November, all of Suncor’s licensing was carried out north of Fort McMurray. While the Fort Hills project itself is centered on mining, this month’s licensing activity suggests that Suncor is allocating resources to its in situ operations including Firebag and MacKay River.

- Whitecap Resources obtained 35 licences this month. Interestingly, all of the licences were located in the company’s “East Division”, which is comprised of Whitecap’s Saskatchewan and Central Alberta assets. In total, the company obtained 6 licences near Estevan, 13 near Kindersley and 2 in Central Alberta with the remainder in spread across other parts of Southern Saskatchewan. While this month’s licensing activity focused on the “East Division”, the company’s 2023 budget indicated ~47% of its capital spending would be in the “West Division.” The Montney and the Duvernay are the future for Whitecap, but continued licensing in the east and the recent acquisition of ~4,000 bbl/d of Viking production from Baytex indicate that the company’s eastern area will remain an important part of Whitecap’s assets.

| Unique Licensees | Licence Count |

| Cenovus Energy Inc. | 222 |

| Suncor Energy Inc. | 126 |

| Canadian Natural Resources Limited | 59 |

| Meg Energy Corp. | 57 |

| ConocoPhillips Canada Resources Corp. | 36 |

| Whitecap Resources Inc. | 35 |

| Strathcona Resources Ltd. | 28 |

| Fort Hills Energy Corporation | 25 |

| Crescent Point Energy Corp. | 22 |

| Teine Energy Ltd. | 22 |

| Other | 372 |

| Total | 1,004 |

Cenovus Licences, November 13 – December 12

ConocoPhillips Montney Licences (Before November 13 in blue, November 13 – December 12 in red)

Whitecap Licences, November 13 – December 12

Producing Formations

- The McMurray formation, as would be expected in an oil sands dominated month, was the most targeted producing formation. The top licensees for the McMurray were Suncor (70 licences), MEG Energy (57 licencess), CNRL (25 licences) and Syncrude (13 licences).

- The Montney formation was busy once again this month, with ConocoPhillips obtaining the most licences with 28. Other active licensees include ARC Resources Ltd. (18 licences) and Ovintiv (13 licences). This month’s Montney licences were split evenly between Alberta and BC.

- The Clearwater was also busy during the period, with 58 licences split between 7 licensees. Strathcona and Headwater Exploration were the most active, with 16 and 15 licences obtained respectively. Strathcona’s licences appear to be clustered in a 16 well pad in township 064-04W4. For a more complete look at the latest happenings in the Clearwater, check out our snapshot report here.

| Producing Formation | Licence Count |

| Mcmurray | 211 |

| Montney | 96 |

| Clearwater | 58 |

| Viking | 54 |

| Duvernay | 30 |

| Waseca | 30 |

| Cardium | 20 |

| Sparky | 12 |

| Spirit River | 11 |

| Frobisher | 11 |

| Others | 471 |

| Total | 1,004 |

McMurray Producing Formation Licences, November 13 – December 12 (Suncor in orange, Syncrude in green, MEG in pink, Syncrude in blue, CNRL in black, Cenovus in brown, All Others in purple)

Montney Licences, November 13 – December 12 (ConocoPhillips in blue, ARC Resources in red, Ovintiv in yellow, All Others in brown)

Clearwater Licences, November 13 – December 12 (Headwater Exploration in purple, Strathcona in grey, All Others in red)

To keep track of the latest licensing activity in the Canadian oil patch for yourself, check out BOE Intel.