CALGARY - No surprises are expected today as shareholders in ARC Resources Ltd. and Seven Generations Energy Ltd. vote virtually on an all-shares transaction to form Canada's sixth-largest oil and gas producer. The merger, valued at $8.1 billion including debt, comes amid a spate of consolidation in the Calgary-based oilpatch but analyst Cody Kwong of Stifel FirstEnergy says what makes it unusual is that it is the combination of two equally well-respected intermediate companies. He says [Read more]

Headlines

Transporting over dimensional loads and complying with provincial requirements

The equipment required to produce oil and gas in the petroleum industry comes in a variety of sizes, from a small wellsite separator to a large compressor. Major components are often mounted on large skids to accommodate the auxiliary equipment required to operate the units. Transportation of oversized equipment may require specialized trucks and additional logistics planning. When it comes to transportation logistics, it is important to consider the equipment dimensions, including the [Read more]

Column: One stuck ship disrupts 12% of global trade – messing with the web of energy and distribution systems is not a joke

Anyone who commutes by car, particularly when going with the flow in a busy direction, is well aware of the chaos that results from some singular dumb little event. Someone rear-ends someone else on a freeway, and the result is two crumpled bumpers and two miles of backed-up traffic. Long weekends on the Trans-Canada highway can turn into multi-hour campouts as the RCMP scratches its head, wondering how on earth two cars could end up like that. Sometimes relatively little events like this [Read more]

Leucrotta Exploration announces completion of its $33 million bought deal financing

CALGARY, Alberta - Leucrotta Exploration Inc. (the "Company" or "Leucrotta") (TSX-V: LXE) is pleased to announce that, further to its press releases dated March 15, 2021 and March 16, 2021, it has closed its previously announced upsized bought-deal financing (the "Bought-Deal Financing") of 41,096,000 units of the Company (the "Units") at a price of C$0.73 per Unit (the "Issue Price") for gross proceeds to the Company of C$30,000,080. In addition, the syndicate of underwriters, co-led by Haywood [Read more]

Gibson Energy announces long-term agreement at its Edmonton terminal and the related sanction of a biofuels blending project

CALGARY, Alberta - Gibson Energy Inc. announced today it has entered into a long-term agreement with Suncor Energy Inc. (“Suncor”) for services at the Company’s Edmonton Terminal and the related sanction of an expansion to support the blending and loading of third-party biofuels for Suncor (the “Biofuels Blending Project”). “We are very pleased to announce a long-term agreement with Suncor, a respected senior Canadian integrated customer, at our Edmonton Terminal,” said Steve Spaulding, [Read more]

Hillcrest Petroleum begins trading on Canadian Securities Exchange under new symbol “HEAT”

VANCOUVER, B.C. - TheNewswire - March 31, 2021 - Hillcrest Petroleum Ltd. (CNSX:HEAT.CN) (OTC:HLRTF) (FRA:7HI.F) (“Hillcrest” or the “Company”) today announced that, further to its news release dated March 29, 2021, the Company is now approved and listed on the Canadian Securities Exchange (“CSE”) trading under the new symbol “HEAT”. Hillcrest’s move to the CSE signals an increased focus on the Company’s mission to accelerate the transition from fossil fuels to clean energy and advance the [Read more]

Hemisphere Energy provides operations update and corporate guidance

Vancouver, British Columbia - Hemisphere Energy Corporation (TSXV: HME) (OTCQB: HMENF) ("Hemisphere" or the "Company") is pleased to announce an update on its operations and provide corporate guidance for 2021 and 2022. Operations Update and Development Plans During the first quarter of 2021 Hemisphere has seen an overall increase in production from its fourth quarter injector conversions. Month-to-date production has averaged 1,850 boe/d (99% heavy oil, based on field estimates between [Read more]

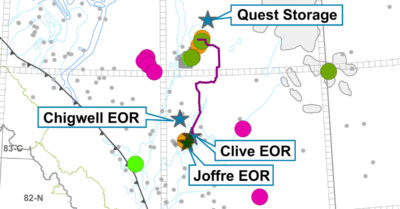

Alberta Has “Tonnes” of Room to Grow Carbon Storage

Carbon capture, utilization and storage (CCUS) is one of the hot topics du jour in the 2021 Western Canada energy landscape…and with good reason! This article focuses on Alberta, which has industrial carbon dioxide emissions that would be good to capture, and a number of viable targets that could store said emissions. Storage targets include depleted gas reservoirs, deep saline aquifers, and enhanced oil recovery (EOR) schemes in oil reservoirs. In 2018, AB produced 144.9 MM tonnes (Mt) of [Read more]

XI Technologies: Production top tens for 2020

Each week, XI Technologies scans their unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you'd like to receive our Wednesday Word to the Wise in your inbox, subscribe here. For years, XI Technologies has published top tens lists examining data from new wells to provide a snapshot of the success of recent drilling efforts. This year, we wanted to expand this snapshot to look at production successes of [Read more]

Prairie Provident announces leadership change

CALGARY, Alberta - Prairie Provident Resources Inc. ("Prairie Provident" or the "Company") (TSX: PPR) announces today that Tony van Winkoop, who currently serves as Chief Executive Officer and a director, has elected to retire from the Company effective May 1, 2021. Mimi Lai, Chief Financial Officer of Prairie Provident and its predecessor since January 2015, has been appointed Interim Chief Executive Officer by the Company's board of directors. "The shareholders, employees and directors very [Read more]