With a new year comes a new outlook for oil and gas prices. Though 2017 was a year of continued belt tightening for many producers in sight of lower for longer commodities prices, 2018 brings with it a glimmer of hope for a more stable pricing environment. Recent rate increases by the US federal reserve and expected continued rate hikes by the Bank of Canada appear to point toward what can be expected to be a more stable era in the North American economy. Though volatility is always present due to inevitable short-term market swings for the oil and gas industry (just ask any producer currently exposed to WCS pricing, or any gas trader how the weather relates to pricing swings), prices appears to be either increasing or at the very least for the WCSB; stabilizing in the face of infrastructure needs.

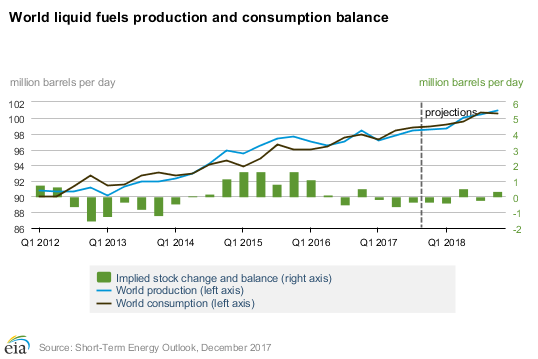

The recent December meeting of OPEC and non-OPEC members achieved the expectation for continued stability in prices throughout 2018 as the current agreement for production quotas was extended to December 2018. This, combined with a stabilized rig count over the past six months appears to point towards the oil market finding some semblance of balance. Over the past quarter, oil prices have been bolstered by the UK Forties pipeline shutdown and political and social discontent in Iran, affecting prices worldwide; but on a larger scale, these price swings will likely fall back more in line with historical trends. With recent numbers released by the EIA suggesting world oil consumption slightly outpacing production over the past year (touted as the desired balance), it is expected that prices should not see any large downward swings in the near future, barring any unforeseen surprises. Though it’s not an entirely rose-coloured outlook, most producers will agree that minor price growth or just price stability is a large improvement over what has occurred over the past couple years when considering oil prices.

Recent trends in the Canadian oil market can be expected to continue putting a damper on Canadian oil prices in the short-term while returning to historical levels later this year. These recent larger discounts to WTI are a result of a perfect storm of additional production coming online when Keystone has pipeline constraints due to a leak in South Dakota, all at the same time that rail capacity is limited by obligations for grains and other shipments. Fortunately, these constraints should be mostly short lived and the current price differentials to WTI should return to levels more consistent with historical values. WCS pricing is expected to recover, but at a slower rate (over the next couple years) as the added production from recent new expansions will hinder prices until more transport capacity is added by the Trans-Mountain pipeline, Keystone pipeline or Line 3 replacement projects.

Henry Hub prices have stayed reasonably stable over the past six months, hovering around the 3.00 USD/MMBtu mark for much of the time. Gas storage, which had been right around the five-year average for much of the past quarter has diminished due to production freeze offs and more heating demand over the past couple weeks caused by the cold snap across much of North America, adding some upward pressure on natural gas prices within the near term. Unfortunately, many banks and analysts share the opinion that the current excess of gas in North America will continue to keep prices in the 3.00 USD/MMBtu for the next couple years. Market access (namely pipeline capacity to markets) continues to be largely limiting the upside for Canadian gas producers, keeping AECO around the 2.00 CAD/MMBtu range for most of the last quarter. This lack of market access is further highlighted by Station 2 gas, which traded for an average of 0.55 CAD/MMBtu over the past three months.

Overall the Canadian dollar has fared better over the second half of 2017 staying around 80 cents US vs the 75 cents seen over the first half of the year. Though the Loonie has recently gained traction against the US Dollar, continuing rate hikes by both Canada and the US will likely work to achieve parallel effects on both currencies. Trump’s recently passed tax bill by most estimates will help the US Dollar, while at the same time, improving commodity prices are expected to keep the Canadian dollar on pace with current exchange rates over the next couple years.

In GLJ’s January 1st, 2018 price forecast, one of the main changes involved reducing our long-term CAD/USD forecast expecting longer term trends to keep the Canadian Dollar comparably lower for longer. Our benchmark oil forecasts were increased to reflect current market conditions while long term prices were slightly increased. Natural Gas benchmarks were modestly reduced in the long term while being revised downward in the near term to reflect the ongoing oversupply throughout the market, particularly in WCSB. Our long-term Brent and WTI crude forecasts are now 68.50 USD/bbl and 66.00 USD/bbl, respectively, expressed in real 2018 dollars. Our long-term Henry Hub gas price forecast is now 3.50 USD/MMBtu, in real 2018 dollars.

Click here for our January 1, 2018 Price Forecast

Justin Mogck is GLJ’s Director of Commodities Research, focusing on commodity price forecasting, corporate evaluations and economic modeling